Hawk tuah girl cryptocurrency lawsuit

The official synopsis for the series reads: “When bad behaviour nukes hotshot QB Russ Holliday’s (Powell) college career, he disguises himself and walks onto a struggling Southern football team as the talented, affable Chad Powers” https://casinolistaustralia.com/.

$HAWK launched on December 4 at 5 pm EST. According to analysis from TRM Labs, it had an initial market capitalization of $490. Within a matter of hours, the value plummeted by 91% and the market cap dropped to $41.7 million. About 10 days later, the value of the token was essentially zero.

James Sallah, Welch’s attorney, confirmed the positive outcome of the SEC investigation. “The SEC closed the investigation without making any findings against, or seeking any monetary sanctions from, Hailey,” Sallah stated.

In the episode, she was joined by FaZe Clan’s founder, Banks, who comforts her as she breaks down in tears over the ordeal.However, the episode was soon deleted and Banks hit out at Welch’s team on X, raising suspicions about how the now-deleted podcast made it online, when he hadn’t green-lit it.

Cryptocurrency market

NFTs are multi-use images that are stored on a blockchain. They can be used as art, a way to share QR codes, ticketing and many more things. The first breakout use was for art, with projects like CryptoPunks and Bored Ape Yacht Club gaining large followings. We also list all of the top NFT collections available, including the related NFT coins and tokens.. We collect latest sale and transaction data, plus upcoming NFT collection launches onchain. NFTs are a new and innovative part of the crypto ecosystem that have the potential to change and update many business models for the Web 3 world.

An altcoin is any cryptocurrency that is not Bitcoin. The word ”altcoin” is short for ”alternative coin”, and is commonly used by cryptocurrency investors and traders to refer to all coins other than Bitcoin. Thousands of altcoins have been created so far following Bitcoin’s launch in 2009.

Price volatility has long been one of the features of the cryptocurrency market. When asset prices move quickly in either direction and the market itself is relatively thin, it can sometimes be difficult to conduct transactions as might be needed. To overcome this problem, a new type of cryptocurrency tied in value to existing currencies — ranging from the U.S. dollar, other fiats or even other cryptocurrencies — arose. These new cryptocurrency are known as stablecoins, and they can be used for a multitude of purposes due to their stability.

The first chain to launch smart contracts was Ethereum. A smart contract enables multiple scripts to engage with each other using clearly defined rules, to execute on tasks which can become a coded form of a contract. They have revolutionized the digital asset space because they have enabled decentralized exchanges, decentralized finance, ICOs, IDOs and much more. A huge proportion of the value created and stored in cryptocurrency is enabled by smart contracts.

Cryptocurrency was invented by Satoshi Nakamoto, which is the pseudonym used by the inventor of Bitcoin. Even though digital currency concepts existed before Bitcoin, Satoshi Nakamoto was the first to create a peer-to-peer digital currency that reliably solved the issues facing previous digital money projects. Bitcoin was initially proposed in 2008 and launched in early 2009. Following the invention of Bitcoin, thousands of projects have attempted to imitate Bitcoin’s success or improve upon the original Bitcoin design by leveraging new technologies.

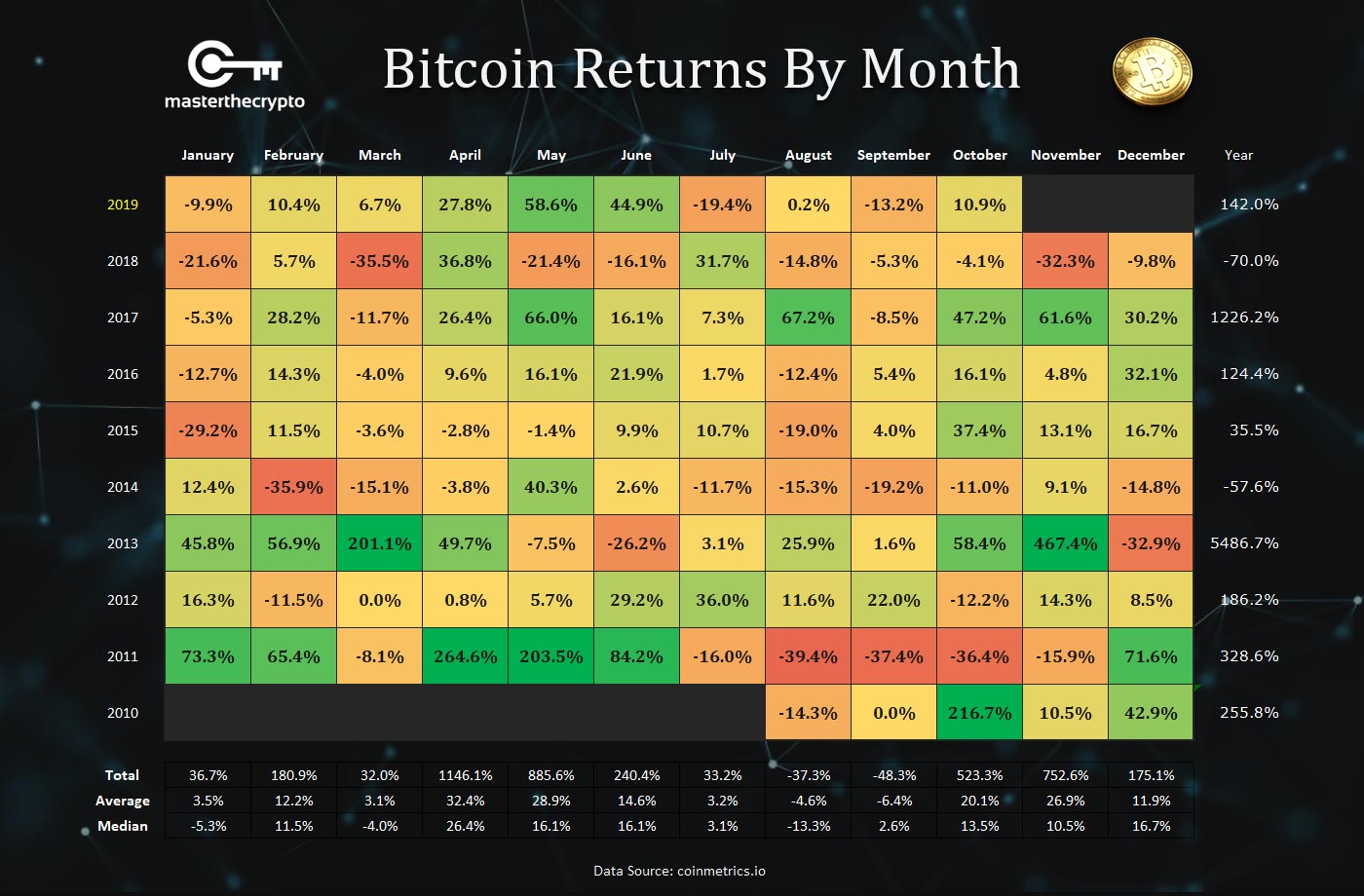

Cryptocurrency bitcoin price

Bitcoin is based on extremely safe SHA-256 cryptography created by the National Security Agency of the U.S., and the bitcoin protocol includes many features protecting it against various vectors of attack, including:

The entire cryptocurrency market — now worth more than $2 trillion — is based on the idea realized by Bitcoin: money that can be sent and received by anyone, anywhere in the world without reliance on trusted intermediaries, such as banks and financial services companies.

Bitcoin is used as a digital currency for peer-to-peer electronic transactions and traded for goods or services with vendors who accept Bitcoins as payment. In fact, Bitcoin spearheaded the cryptocurrency market, an ever-growing collection of digital assets that can be sent and received by anyone anywhere in the world without reliance on intermediaries.

You can buy almost anything with Bitcoin. The cryptocurrency has been around for a long time, and it’s only getting more popular as time goes on. You can purchase items online and in-store, and even use your Bitcoin to purchase an investment property. One of the biggest advantages of using Bitcoin as an online payment method is its anonymity. You can make purchases without having your identity tied to the transaction at all times.

Bitcoin is based on extremely safe SHA-256 cryptography created by the National Security Agency of the U.S., and the bitcoin protocol includes many features protecting it against various vectors of attack, including:

The entire cryptocurrency market — now worth more than $2 trillion — is based on the idea realized by Bitcoin: money that can be sent and received by anyone, anywhere in the world without reliance on trusted intermediaries, such as banks and financial services companies.

Cryptocurrency news

On May 12, Hobbs rejected Senate Bill 1373, which sought to establish a Digital Assets Strategic Reserve Fund. The fund would have allowed Arizona to hold crypto assets obtained through seizures or legislative allocations.

Stablecoin issuer Tether bought $458.7 million worth of Bitcoin for Twenty One Capital on May 13, a Bitcoin investment firm it backed that’s working on a Special Purpose Acquisition Company (SPAC) merger with Cantor Equity Partners.

Its Bitcoin holdings are the third-largest among public companies, trailing only Strategy, formerly MicroStrategy and Bitcoin mining firm MARA Holdings at 568,840 Bitcoin and 48,237 Bitcoin, respectively.

“Current volatility in cryptocurrency markets does not make a prudent fit for general fund dollars,” she stated in her veto letter. “I have already signed legislation this session which allows the state to utilize cryptocurrency without placing general fund dollars at risk,” she added.

Arizona Governor Katie Hobbs vetoed two key cryptocurrency-related bills that aimed to expand the state’s involvement in digital assets while signing a strict regulatory measure targeting Bitcoin ATMs.